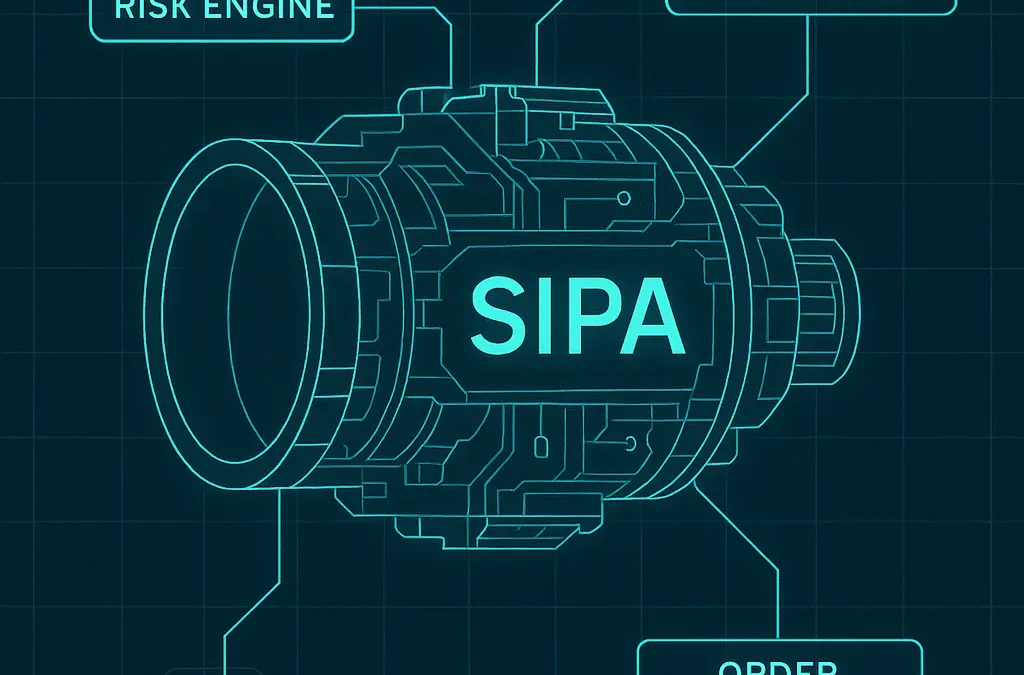

Understanding what a system does is one thing; understanding how it does it reveals its true capability and potential. SIPA (Sophisticated Intelligent Portfolio Assistant) is not a monolithic black box; it’s a highly functional system built on a foundation of meticulously engineered components, each playing a critical role in its autonomous portfolio management capabilities. Let’s lift the hood and examine its core functionalities.

At the base level is Data Access (LUKA). This module is the system’s gateway to market information. It’s designed for secure, reliable retrieval of historical and real-time data from exchanges, ensuring that every decision SIPA makes is based on accurate and timely information stored in our centralized MariaDB. No chaotic direct exchange access; data flows through LUKA, ensuring integrity and consistency.

Feeding this data into the intelligence layer is Feature Engineering (ROKO). This is where raw data is transformed into actionable insights. ROKO calculates a comprehensive suite of technical indicators (SMA, EMA, RSI, MACD, Bollinger Bands, etc.) and potentially other relevant features, preparing the data for algorithmic analysis. The quality of feature engineering directly impacts the performance of the learning models.

The brain of SIPA resides within the Machine Learning (DABI) and Reinforcement Learning (SAAN) modules. DABI applies sophisticated ML algorithms to identify patterns and generate predictive signals. SAAN employs RL to train agents that learn optimal trading strategies through interaction with market data, continuously refining their approach based on performance feedback. This is where static rules are replaced by dynamic, adaptive intelligence.

Crucially, Risk Management (NANA) is not a separate function but an integrated component guiding the decision-making process. NANA assesses market risk, calculates exposure, and implements controls to ensure that trading activities remain within predefined risk tolerance levels. This includes dynamic position sizing and the implementation of stop-loss and take-profit mechanisms. No intelligent system operates effectively without a robust risk framework.

Once a trading decision is made, Execution (TEEA) takes over. This module is responsible for sending precise trade orders to exchanges via the Connectors (VIDA) module. TEEA is designed for speed and reliability, ensuring that trades are executed efficiently at desired price points. VIDA provides the necessary interfaces to interact with various exchanges, with initial focus on Kraken and an architecture ready for expansion.

Overseeing the entire process is the Orchestration (DANI) module. This is the central nervous system, coordinating the flow of information and actions between all other modules, from data ingestion and analysis to strategy generation, risk assessment, and trade execution.

Finally, Analytics (JAAN) provides the critical feedback loop, monitoring system performance, tracking trades, and generating reports. This data is essential for both performance evaluation and for feeding back into the learning modules for continuous improvement.

These core functionalities, built on a solid technical foundation and interacting within a strictly modular architecture, represent the power of SIPA. It’s a system engineered for intelligent, autonomous portfolio management, designed to operate with precision and resilience in the complex world of digital assets.

Leverage cutting-edge AI algorithms and machine learning to transform your cryptocurrency trading strategy. Let your portfolio grow while you focus on what matters.