ASKY – Intelligent Portfolio Allocation and Rebalancing Engine

ASKY doesn’t chase profits. It allocates power.

💼 What is ASKY?

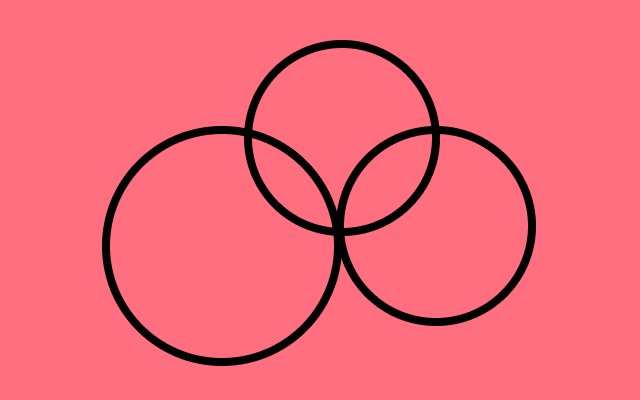

ASKY (Asset Strategy Keeper & Yield allocator) is SIPA’s capital allocation, portfolio tracking, and rebalancing engine. It manages how funds are distributed across assets, strategies, and exchanges in real-time — ensuring SIPA operates within defined capital rules, risk constraints, and efficiency goals.

While DANI decides if to trade, and TEEA executes what to trade, ASKY manages how much, where, and why.

It acts like a quant fund manager, dynamically adjusting portfolio weights based on performance, volatility, market conditions, and strategy results.

⚙️ Core Responsibilities of ASKY

-

Capital Allocation:

-

Calculates capital weights per strategy (DABI, SAAN) and per asset.

-

Supports allocation models:

-

Equal-weighted

-

Volatility-adjusted

-

Risk-parity

-

Confidence-weighted (based on DABI signal strength)

-

-

-

Portfolio State Tracking:

-

Tracks:

-

Holdings per asset and exchange

-

Exposure per strategy

-

Unrealized and realized PnL

-

Capital utilization vs. available funds

-

-

-

Automated Rebalancing:

-

Triggers rebalancing based on:

-

Drift from target allocations

-

New strategy signals

-

Portfolio volatility spikes

-

-

Sends rebalancing orders through

TEEAwithNANAvalidation

-

-

Performance Attribution:

-

Analyzes returns per:

-

Asset

-

Strategy

-

Timeframe (hourly, daily, weekly)

-

-

Produces cumulative yield curve + alpha/beta breakdown

-

-

Capital Efficiency Monitoring:

-

Highlights idle capital, underperforming strategies, over-exposure flags

-

Recommends capital redistribution or “asset sleep” state

-

-

Historical Allocation Analysis:

-

Logs all portfolio weight transitions

-

Allows backtesting of allocation methods vs. returns

-

🧩 ASKY’s Role in SIPA Architecture

| Module | Interaction |

|---|---|

DANI |

Receives allowed capital per trade & strategy cap |

TEEA |

Gets order sizes and balance constraints |

NANA |

Filters position sizing against risk budget |

JAAN |

Receives logs of allocation history and effectiveness |

VIDA |

Feeds live balance snapshots per exchange |

TATA |

Displays current allocations to end users |

MARK |

Ensures ASKY runs periodically as background service |

💰 Supported Allocation Models

| Model | Description |

|---|---|

| Fixed % | Manual asset weights (e.g. BTC 50%, ETH 30%) |

| Volatility Weighted | Lower risk assets get higher weight |

| Signal Confidence | Allocates more to high-confidence predictions |

| Kelly Criterion | Optional (planned Q2 2026) |

| Risk Parity | Equalized volatility contribution from each asset |

💾 Technical Stack & Storage

| Feature | Details |

|---|---|

| DB Storage | MariaDB → portfolio_allocations, rebalancing_logs |

| Output Format | JSON, .csv, .xlsx, internal dicts |

| Rebalancing Trigger | Time-based (hourly), event-based (triggered by DANI) |

| Simulation Mode | Yes – runs in TEST mode using virtual balances |

-

🔐 Compliance & Capital Segmentation

-

Tracks user capital separately (multi-user SaaS ready)

-

Supports per-strategy capital budget (e.g. 40% max for DABI)

-

Enforces liquidity minimums and exchange-specific margin rules

-

Logs every capital movement and allocation decision for audit trail

-

📈 SEO Summary

-

Crypto portfolio management module for AI trading systems

-

Capital allocation engine for algorithmic crypto bots

-

Rebalancing and risk-adjusted asset weighting for automated trading

-

Trading bot fund distribution and efficiency monitoring layer

-

Real-time crypto bot portfolio tracker with PnL analytics

🧑💼 Who Uses or Needs ASKY?

-

Quant Traders: Want fine-grained control over strategy-level capital

-

Investors & Fund Managers: Monitor allocation, performance, drift

-

SaaS Clients: Track their own portfolio allocation and ROI in real time

-

AI Engineers: Feed strategy weighting back into ML pipeline

-

Compliance Teams: Validate that capital is not over-concentrated

🔮 ASKY Roadmap (Q2–Q4 2026)

-

On-chain wallet balance sync (Ethereum, Solana)

-

NFT portfolio allocation module (DeFi/NFT fund structuring)

-

Dynamic capital optimization via ML (meta-optimizer)

-

Real-time cross-account rebalance via

TATAUI -

Risk-adjusted ROI scoring dashboard with NLP interface

✅ Recap:

ASKY is SIPA’s portfolio brain and allocation conscience.

It doesn’t just track balances — it optimizes capital, protects exposure, and fuels alpha.

Because in trading, smart execution is nothing without smart allocation.

Evolving with Monitoring and Rebalancing

Your financial voyage is an ongoing process. Regular evaluations of your mutual fund investments are pivotal to ensure alignment with your objectives. Fluctuations in market values necessitate periodic rebalancing for optimal risk and return management.

Flexible Trading Modes

SIPA adapts to your comfort level and trading style with three distinct operational modes

Leverage cutting-edge AI algorithms and machine learning to transform your cryptocurrency trading strategy. Let your portfolio grow while you focus on what matters.