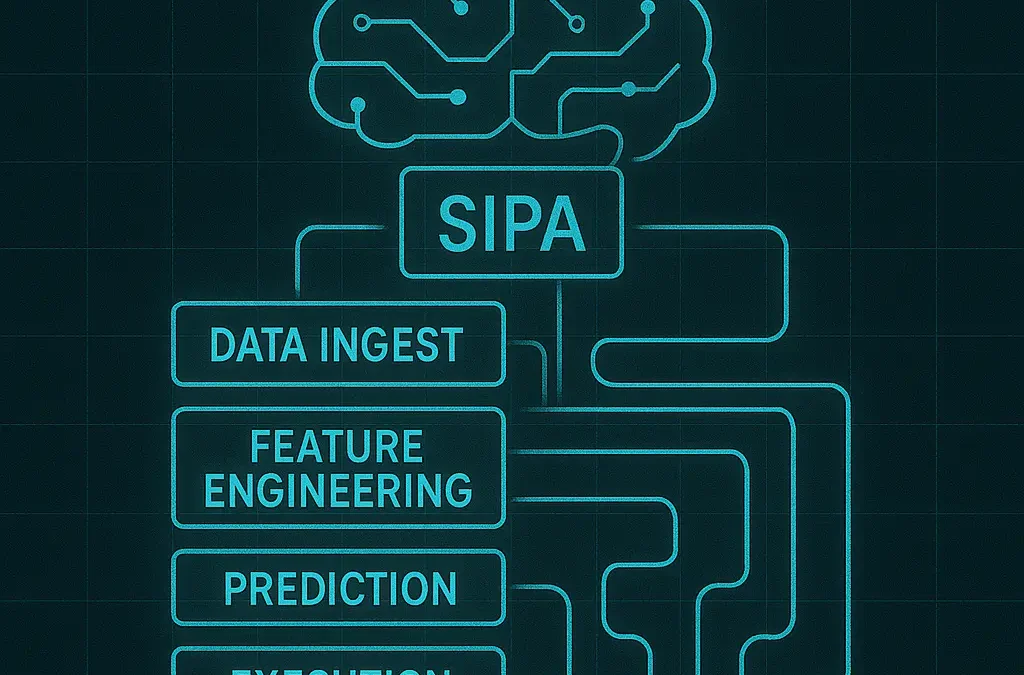

In the domain of complex software systems, particularly those operating in high-frequency, high-stakes environments like algorithmic trading, architecture is paramount. A monolithic, tightly coupled system is a liability, prone to cascading failures and resistant to innovation. SIPA (Sophisticated Intelligent Portfolio Assistant) is designed as a testament to the power of modularity, an architectural approach that imbues the system with resilience, scalability, and the capacity for continuous evolution.

SIPA’s architecture is fundamentally a modular monolith, a pragmatic choice that balances the benefits of discrete components with the performance advantages of a single deployment unit in this specific application. The system is divided into distinct modules, each with a clearly defined responsibility and a well-articulated interface for interaction with other modules. This isn’t just organizational neatness; it’s a principle that enforces low coupling and high cohesion – the hallmarks of a robust and maintainable system.

Consider the separation: the LUKA module is solely responsible for data access, acting as a guardian of the centralized MariaDB, preventing direct, uncontrolled database interactions from other parts of the system. The VIDA module handles all external communication with exchanges, abstracting away the complexities of different APIs and ensuring that the core logic remains exchange-agnostic. Feature engineering is strictly the domain of ROKO, prediction modeling within DABI, reinforcement learning within SAAN, and risk management encapsulated entirely within NANA. Execution logic resides in TEEA, orchestrated by the central DANI module.

This strict separation of concerns provides several critical advantages:

Resilience: A failure or issue within one module is less likely to propagate and bring down the entire system. Modules can be tested and validated independently.

Maintainability: Updates or bug fixes can be applied to individual modules without requiring a complete system overhaul. Developers can focus on specific areas without needing to understand the entire codebase deeply.

Scalability: While a monolith, the modular design makes it easier to identify performance bottlenecks within specific modules and optimize them independently, or even eventually consider scaling out specific components if necessary.

Evolvability: New features, algorithms, or connectors can be integrated by adding or modifying specific modules with minimal impact on the rest of the system. This is particularly crucial for incorporating future advancements in AI or expanding to new markets.

Unlike many ad-hoc trading scripts or poorly structured systems, SIPA’s modular architecture is a deliberate engineering choice that provides the flexibility and stability required to operate effectively in a dynamic and adversarial market. It’s the unseen scaffolding that ensures the intelligence, risk management, and execution layers can perform their functions reliably and efficiently. This is the technical foundation upon which SIPA’s long-term viability and potential for sustained performance are built.

Leverage cutting-edge AI algorithms and machine learning to transform your cryptocurrency trading strategy. Let your portfolio grow while you focus on what matters.