JAAN – Analytics, Monitoring and Strategic Evolution Engine

JAAN remembers every trade, reports every outcome, and evolves every strategy.

📊 What is JAAN?

JAAN (Judgment, Analysis And Navigation) is SIPA’s centralized analytics, reporting, and performance evaluation engine. It’s responsible for transforming raw trade logs, market actions, AI decisions, and risk events into human-readable, machine-optimized insights.

JAAN provides the operational visibility, strategy feedback, and evolutionary metrics needed to continuously improve SIPA’s performance – for both autonomous AI and human users.

Whether you’re debugging a bad signal, tracking portfolio growth, or optimizing strategy parameters, JAAN is the mirror SIPA uses to evolve.

⚙️ Core Responsibilities of JAAN

-

Trade Logging & Attribution:

-

Logs every executed, canceled, or blocked trade with:

-

Source module (DANI/DABI/SAAN)

-

Prediction confidence

-

Portfolio impact

-

SL/TP result

-

Execution lag & slippage

-

-

-

Performance Dashboards:

-

Computes and displays:

-

Win rate, avg gain/loss per trade

-

Realized vs. unrealized PnL

-

Risk-adjusted return (Sharpe, Sortino)

-

Exposure concentration

-

Strategy-level profitability

-

-

-

Model Evaluation & Drift Detection:

-

Tracks:

-

Prediction accuracy over time

-

Model vs. live performance divergence

-

Data drift in input features (ROKO)

-

Signal decay patterns

-

-

Flags underperforming models for retraining

-

-

Portfolio Analytics:

-

Real-time tracking of:

-

Total asset value (by exchange)

-

Allocation per asset and per strategy

-

Capital efficiency

-

Drawdown history

-

-

Integrates with

ASKYfor live rebalance visualization

-

-

User Reporting & Web Dashboard:

-

Generates:

-

Daily/weekly/monthly trading reports

-

Strategy comparison charts

-

Telegram/email summaries (via

TAMI)

-

-

Connected to

TATAweb dashboard for real-time insights

-

-

Strategic Feedback Loop:

-

Sends evolution metrics to

DABI,SAAN,NANA:-

Strategy performance scoring

-

Optimal holding times

-

Latency vs. slippage correlation

-

Time-of-day alpha pockets

-

-

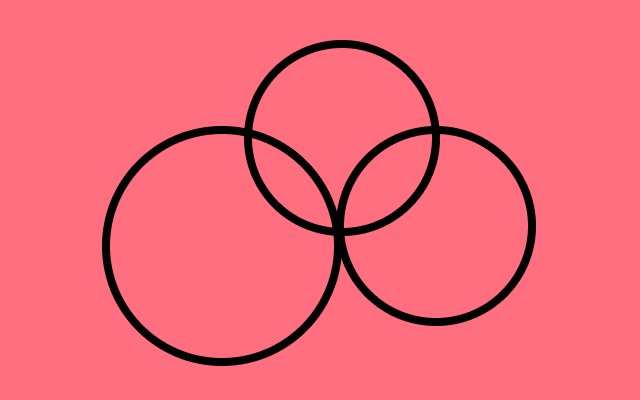

🧩 JAAN’s Role in SIPA Architecture

| Module | Dependency |

|---|---|

TEEA |

Sends execution metadata, slippage, fill status |

DANI |

Sends decision rationale and outcome trace |

DABI |

Receives feedback on prediction accuracy |

SAAN |

Receives episodic reward curve and evolution flags |

ASKY |

Provides asset allocation performance and rebalancing metrics |

TAMI |

Distributes reports and summaries to users |

📈 Data Types & Metrics Tracked

-

Per Trade:

-

Entry/exit time

-

Trade reason (signal ID)

-

Confidence, signal source, latency

-

PnL, SL/TP hit status

-

-

Per Strategy:

-

Number of trades, Sharpe ratio, % win

-

Max drawdown, best/worst performer

-

-

Per Asset:

-

Net return, exposure time, volatility impact

-

-

System Level:

-

Portfolio equity curve

-

Overall system risk score

-

Signal vs. action divergence

-

💾 Storage & Compatibility

| Type | System |

|---|---|

| Logging Format | Structured MariaDB, .csv backup |

| API Access | Internal API for frontend/dashboard |

| Report Exports | .pdf, .xlsx, .json, .md |

| Frontend Integration | TATA dashboard (React + FastAPI) |

| Time Granularity | Real-time, hourly, daily aggregates |

-

🔐 Auditability, Compliance & Security

-

Every trade and decision stored with timestamp + signature

-

GDPR and MiCA compliant logs

-

Data encryption for exported reports

-

Supports per-user access logs for SaaS version

-

Crypto bot analytics and reporting engine

-

AI trading system performance tracker with visual dashboards

-

Backtest and live trade analyzer for algorithmic strategies

-

Trade signal evaluator and ML model feedback module

-

Crypto risk analytics and PnL reporting for AI trading bots

-

👨💼 Who Benefits from JAAN?

-

Traders & Investors: See what happened, when, and why

-

Quant Developers: Track prediction reliability, model decay, data drift

-

Risk Analysts: Monitor drawdowns, exposure, and compliance thresholds

-

Founders & Execs: View system health, ROI, churn, and strategic gain

-

SaaS Clients: Get transparent reporting and performance insight per account

🔮 JAAN Roadmap (Q4 2025 – Q2 2026)

-

Real-time heatmaps of alpha clusters

-

Interactive drag-and-drop strategy report builder

-

Voice-based trade log interpreter (via OpenAI Whisper + GPT API)

-

NLP explanation layer for every trade decision

-

Custom KPI builder with webhook notifications

✅ Recap:

JAAN is how SIPA sees itself – intelligently, honestly, and constantly evolving.

In a world obsessed with prediction, JAAN obsesses over truth, results, and evolution.

Because what can’t be measured, can’t be improved. And SIPA improves relentlessly.

👨💻 Who Benefits from LUKA?

-

AI Developers: Clean, structured data ready for training and inference

-

Quant Researchers: Deep historical datasets for strategy testing

-

Analysts: Full market history per asset with sentiment overlays

-

Traders: Backtest your edge with real-world market conditions

-

SaaS Users: Never worry about missing data or exchange outages

🔮 Roadmap (Q1–Q3 2026)

-

GPU-accelerated ingestion using RAPIDS.ai

-

Decentralized backup to IPFS / Arweave

-

NLP-based full-text sentiment parser (headlines, tweets)

-

Ingest on-chain metrics (DEX volume, wallet activity)

-

Web UI to control ingestion sources & sync status (

TATAdashboard)

✅ Recap:

LUKA is the data heartbeat of SIPA.

No predictions, trades, signals, or analytics happen without it.

In a system obsessed with intelligence, LUKA is the memory — deep, fast, and brutally precise.

Evolving with Monitoring and Rebalancing

Your financial voyage is an ongoing process. Regular evaluations of your mutual fund investments are pivotal to ensure alignment with your objectives. Fluctuations in market values necessitate periodic rebalancing for optimal risk and return management.

Flexible Trading Modes

SIPA adapts to your comfort level and trading style with three distinct operational modes

Leverage cutting-edge AI algorithms and machine learning to transform your cryptocurrency trading strategy. Let your portfolio grow while you focus on what matters.